Blog

A hint of North Africa

You know when you’ve got that Friday feeling but there are still at least 4 hours left of the working day? Well, if you are out and about in Old Town, Swindon and have an hour or so to spend for lunch I really recommend you visit Fez on Wood Street (wearing the Fez...

More compliance for trustees…

If you are a trustee of a trust, or know someone that is, then I recommend that you read on…as whilst is not a particularly interesting subject, new requirements are being placed on trustees with the potential for penalties to be charged for non-compliance. Money...

HMRC to collect tax on residential property sales within 30 days

Further to my blog on 27 August 2019, in which I highlighted the changes that are coming into main residence and letting relief, changes are also being made to the way that capital gains tax is payable on the sale of residential properties with effect from 6 April...

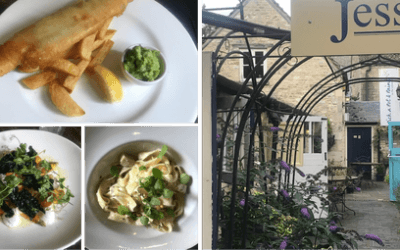

Jesse’s Bistro

Well this is a Cirencester blog lunch first! Today Ian and I are joined by Nick Waloff and Chris Leibbrandt of Cotswold Taste Limited a not for profit co-operative that amongst many other things is intended to help consumers choose food and drink which comes directly...

Residential property owners hit again…

You have to ask yourself what the government has against property owners when they appear to be penalising them through the way their property income and gains are taxed. First there was the change to the way that tax relief was given on loan interest and then there...

Tapped out on Tapas

It seems a very long time since I was lucky enough to have a ‘business lunch’ near our Swindon office. There aren’t many places I’ve not tried in Old Town and looking for something informal and relaxing we decided to go to a favourite evening haunt of mine Los Gatos....

Get in touch

We’re always happy to hear from new and existing clients